Leveraging AI in Asset Management

Asset managers face growing pressures: tightening market cycles, escalating client expectations, and complex regulatory landscapes. AI has emerged as a game-changing solution, but harnessing it securely and efficiently remains challenging.

55% of enterprises have paused or killed GenAI projects over fears of sensitive‑data leakage, privacy lapses, and security gaps.

This post outlines practical strategies for integrating AI into asset management workflows. Learn how leading firms are using AI to dramatically boost productivity, while safeguarding sensitive data, meeting stringent regulatory demands, and ensuring complete control over proprietary insights.

The Compelling Case for AI

AI is quickly becoming a core strategic asset for investment managers seeking greater efficiency, sharper insight, and operational leverage. As portfolio complexity grows and market cycles compress, firms that embrace intelligent tooling stand to gain meaningful edge. AI has already demonstrated its value across due diligence, credit underwriting, financial modeling, and investor reporting.

Recent adoption data underscores this momentum:

- According to McKinsey, 78% of high-performing firms have already embedded AI into at least one business unit.

- Manufacturing and retail—historical AI laggards—saw 20x and 24x year-over-year employee AI adoption growth, respectively.

- AI's practical impact is increasingly clear in investment workflows, enabling firms to underwrite deals faster, summarize complex financials at scale, and reduce research time across hundreds of issuers.

That said, adoption has not come without challenges. Cyberhaven's recent survey of over 700 AI tools found that 72% fall into high or critical risk categories. Only 11% qualify as low risk. This data reinforces what most investment professionals intuitively understand: the promise of AI is compelling, but without the right safeguards and deployment strategy, the risks to data security, vendor lock-in, and regulatory exposure are substantial.

In this post we explore the current landscape, both the excitement and hesitation, around AI integration in asset management. We then offer pragmatic answers to common questions, framed around secure, scalable, and verifiable implementation.

Immediate Impact: Productivity Gains Within One Quarter

According to McKinsey's 2025 AI Report, investment functions utilizing AI for knowledge retrieval, summarization, and analysis have seen productivity improvements between 8% and 13%. While on the surface that seems negligible, that's 150% productivity gain in less than one year.

Routine tasks in asset management, such as financial document summarization, credit commentary drafting, and basic screening, can be meaningfully accelerated with general-purpose LLMs.

Asset management tasks traditionally require significant time and human capital. AI accelerates these dramatically:

High-Yield Use Cases That Pay Back Inside One Quarter

| Workflow | Manual Time | AI-Enhanced Time | Time Savings |

|---|---|---|---|

| Credit document review | 3–4 hours | 15–20 minutes | 85% |

| Sector summary synthesis | 8+ hours | 30–45 minutes | 90% |

| Quantitative financial screening | 4–5 hours | 10–15 minutes | 90% |

| LP/client reporting letter generation | 1–2 days | 30–45 minutes | 90% |

| Investment memorandum preparation | 2–3 days | 3–4 hours | 85% |

Firms implementing AI-driven processes quickly see substantial returns, radically transforming their operating models and enabling deeper analysis, enhanced client interactions, and faster decision-making.

Asset management firms are experiencing this transformation across three critical dimensions:

1. Investment Decision Enhancement

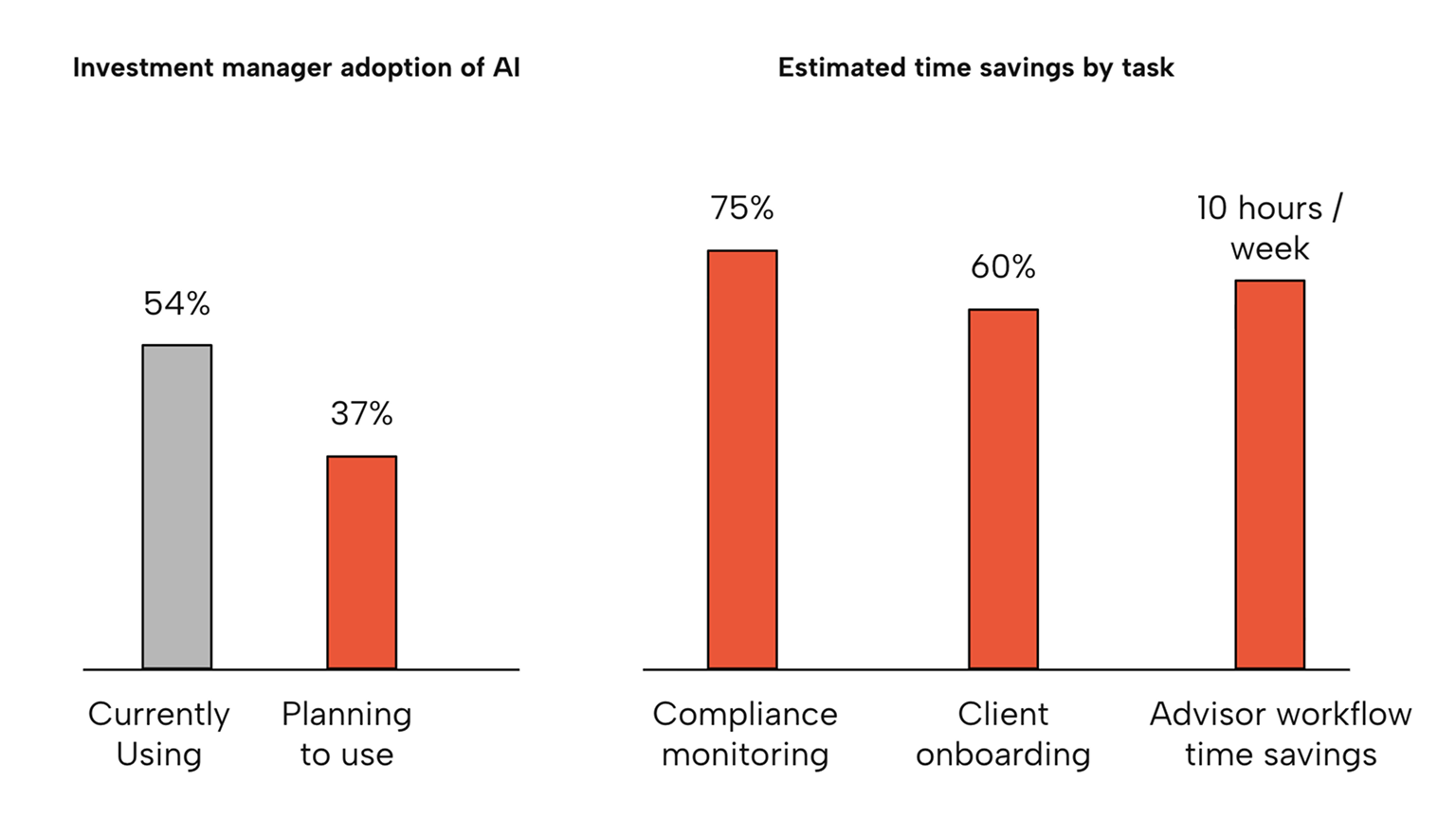

AI-powered analytics now delivers significant advantages in portfolio construction and management. Currently, 91% of asset managers are either using (54%) or planning to use (37%) AI within their investment strategy and asset-class research workflows, representing widespread adoption beyond traditional quantitative teams. The most successful implementations leverage machine learning to identify investment opportunities that traditional screening methods would miss, particularly in detecting non-linear relationships in market data.

2. Operational Efficiency and Workflow Automation

The operational backbone of asset management benefits substantially from AI implementation. Integrating AI with customer relationship management (CRM) platforms delivers "productivity enhancements" by automating "manual administrative tasks, such as pre- and post-meeting paperwork, dynamic agendas, or tracking life events and milestones for clients in real time."

3. Client Experience and Personalization

Asset managers leveraging AI to enhance client experiences are seeing measurable improvements in client satisfaction and retention. According to PwC's 2024 Asset & Wealth Management Report, 80% of asset managers report that "disruptive technologies such as AI will fuel revenue growth," with 84% noting operational efficiency improvements and 72% citing employee productivity gains.

Overall, asset managers implementing AI across these core workflows are experiencing compound productivity benefits that radically transform their operating models. The combined effect extends beyond simple time savings, enabling deeper analysis, more frequent client touchpoints, and an expansion of investment opportunities that can be properly evaluated. This creates a virtuous cycle where efficiency improvements drive both better investment outcomes and enhanced client relationships.

The "Shadow IT" Problem in AI

42% of companies report employees using unauthorized AI tools with work data (Source: Salesforce). When organizations delay formal AI rollouts, employees bypass security controls entirely. That analyst or intern copying customer data into ChatGPT? That's a regulatory violation or customer trust issue waiting to happen.

The Next Frontier of AI & Finance

Gartner's 2025 projection suggests the majority of enterprise AI applications will focus on domain-specific, private deployments, emphasizing the importance of precision and privacy over generalized capabilities (Gartner).

Many publicly available AI models remain effective primarily at preliminary research or summarization stages, often described as reaching "foothills" rather than "mountain summits." While this is an overblown assertion, it is nevertheless apparent there are barriers for firms seeking true competitive differentiation. Our conversations with CIOs across asset management reveal a consistent pattern: initial excitement with public AI models quickly gives way to frustration when attempting to integrate them with proprietary investment processes. The models that drive headlines are fundamentally unsuited for handling sensitive financial data, lack critical domain expertise in capital markets, and create material compliance risks due to their "black box" nature.

These limitations are driving an arms race among sophisticated asset managers. According to BCG's AI and the Next Wave of Transformation: Global Asset Management Report, "the technology is rapidly developing, and asset managers that do not start their journey now risk being left behind." The stakes are particularly high as early adopters with functioning, compliant systems report substantial alpha generation and operational advantages. As one CIO of a global multi-strategy firm told us: "The difference between having a working, private AI system and not having one is becoming as significant as the gap between quantitative and discretionary approaches was a decade ago." Yet these same firms face daunting challenges in building systems that maintain the confidentiality of their investment IP, satisfy increasingly complex regulatory requirements around model explainability, and provide sufficient security guarantees for client data.

When it Comes to AI for Asset Management There's Deck and Then Everyone Else

Asset managers consistently cite three barriers to broader AI adoption:

- Data Security and Privacy: Public AI platforms often lack robust security and transparency, making sensitive financial data vulnerable.

- Regulatory Compliance: AI deployments require explainability and compliance mechanisms that many current tools do not adequately provide.

- Vendor Lock-in: Firms frequently face difficulties extracting their data or switching providers, limiting strategic flexibility.

Deck vs. Traditional SaaS AI Platforms

| Feature | Typical SaaS AI Providers | Deck Private AI |

|---|---|---|

| Data Ownership | Data stored on vendor-managed servers | Data remains securely in client-controlled environments |

| Security Verification | Limited transparency | Cryptographic proof of security and data handling |

| Portability | Challenging to extract data | Easy data export and platform flexibility |

| Compliance Readiness | Complex, opaque compliance posture | Built-in auditability and regulatory alignment |

When it Comes to Privacy There's Deck and Then Everyone Else

The Broken State of AI Data Security

Most current AI vendors utilize multi-tenant SaaS models with the result being some or most often all of the below:

- Limited transparency into data handling practices

- Significantly challenging for firms to confidently control or retrieve their data

- Well-founded concerns around vendor lock-in and compliance risk

This approach fundamentally misaligns with the requirements of sophisticated asset managers. According to Mercer's industry survey, "data security should be at the core of responsibly using AI in the business" for investment firms. Yet the reality falls short of this imperative.

Trust Claims vs. Technical Guarantees

Platforms like ChatGPT or SaaS-based vendors often assert data security but rely on trust rather than verifiable technical guarantees. Reviews and user feedback frequently note concerns about data visibility, insufficient transparency, and limited portability.

The implications for asset managers are particularly severe. As EY notes in their analysis, firms must establish "robust operating model playbooks and reusable frameworks, inclusive of appropriate governance and controls for different risk tiers and technology patterns" to deploy AI responsibly. Without verifiable security and clearly defined data controls, this becomes impossible.

About Deck

Deck provides a platform that empowers deal teams to move faster and do better work. Deal teams that have leveraged Deck have experienced a 5x increase in productivity and ~80% reduction in overhead. Deck automates the core tasks associated with deal execution including internal memo and slide creation, deep diligence, and intelligent reasoning across your files. All through the voice and format that aligns with your team.

Our Platform Features:

- Private Model Execution: TEE-based inference with hardware attestation

- Complete Audit Trails: Every query logged and verifiable

- Enterprise Integration: Seamless connection to existing data and identity systems

Trusted by:

- Fortune 500 institutions

- Leading technology companies

- Government agencies