Why ChatGPT Can't Handle Your Deal Analysis

When ChatGPT burst onto the scene, many investment professionals wondered if their research and memo-writing workflows were about to be revolutionized. The initial experiments were promising as these tools could draft decent summaries, help with formatting, and even generate reasonable first-pass analyses of individual documents.

But as teams began pushing these general-purpose AI tools deeper into their actual deal processes, the limitations became apparent. What works for writing emails or summarizing news articles breaks down quickly when applied to the nuanced, context-heavy world of private market investment analysis.

However, Deck provides contextual understanding at scale, across your deals, diligence files, legal agreements, more. While general AI tools might help with individual document summaries, a purpose-built solution can maintain awareness of your entire deal context while generating analysis that reflects your fund’s specific methodology and standards.

Most AI tools can handle roughly 10-15% of a typical deal package, forcing teams to either work with incomplete information or spend hours manually chunking documents defeating the entire purpose of AI assistance.

Surface-Level Analysis Doesn't Cut It

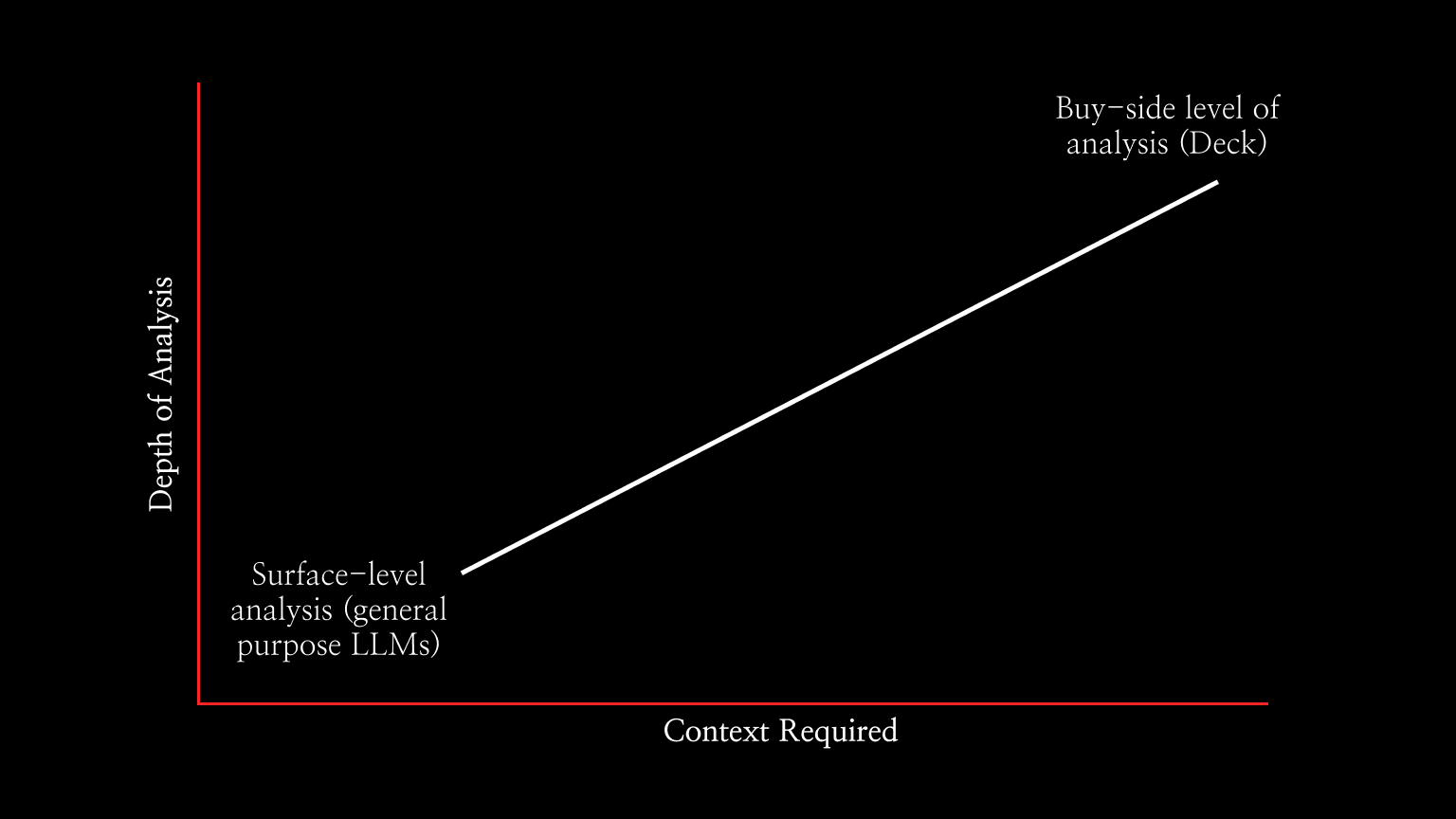

Most general AI tools excel at what we might call “surface-level” analysis. Feed ChatGPT or Gemini a single management presentation, and you’ll get back a coherent summary highlighting key metrics, market positioning, and growth strategies. For an analyst doing preliminary research, this can be genuinely helpful.

The problem emerges when you need to go deeper. Real investment analysis requires synthesizing information across dozens of documents—management presentations, historical financials, market research, customer references, legal documents, and competitive analyses. Each document provides a piece of the puzzle, but the investment thesis emerges from understanding how these pieces fit together within your fund’s specific investment framework.

What Context Limitations Mean for Your Analysis

The mathematics of modern deal analysis reveal why general AI tools hit walls so quickly. A Confidential Information Memorandum (CIM) can range from 50 to over 150 pages, while a management presentation alone can typically span 30 to 40 pages. Add supporting financial models, market research, legal documents, and call notes and emails, and you’re easily looking at 300-500 pages of material that needs simultaneous analysis. Not to mention across a wide variety of formats.

Here’s where the numbers become problematic. Using the general conversion of approximately 1,000 tokens to 750 English words, a four-page single-spaced document consumes roughly 3,500-4,000 tokens. This means a typical CIM of 100 pages would require approximately 75,000-100,000 tokens just for that single document before you even begin adding the dozens of other materials essential for thorough analysis.

The Current Reality:

- GPT-5 has a 400,000 token context window and GPT-4o offers a 128,000 token context window but limits individual responses to just 4,096 tokens

- Google Gemini provides up to 1 million tokens for Gemini Advanced users, though free tier users are limited to around 32,000 tokens

Even with these larger context windows, the limitations remain problematic for real-world deal analysis. Consider what a comprehensive deal package conservatively contains:

- CIM: 75,000-100,000 tokens

- Financial models and projections: 60,000-100,000 tokens

- Management presentations: 40,000-65,000 tokens

- Industry and market research: 40,000-60,000 tokens

- Legal documents (term sheets, contracts): 20,000-35,000 tokens

- Company diligence materials: 50,000-60,000 tokens

- Customer references and call notes: 15,000-25,000 tokens

- Competitive analysis: 20,000-30,000 tokens

Total: 320,000-475,000 tokens minimum

Context Decay and Firm Specific Frameworks

The limitations go beyond simple capacity constraints:

-

Studies have shown that models perform best when relevant information is at the beginning or end of the input context, and performance degrades when the model must carefully consider information in the middle of a long context. This “lost in the middle” problem is particularly problematic for investment analysis where critical insights often emerge from cross-referencing information scattered throughout extensive documentation. For investment professionals working with comprehensive deal materialsthis means the AI’s analytical capabilities deteriorate precisely when they’re needed most.

-

Perhaps more critically, general AI tools lack the ability to apply your fund’s specific investment frameworks and analytical approaches. Every fund develops its own methodology for evaluating deals—specific metrics they prioritize, red flags they watch for, and analytical frameworks they’ve refined over years of successful (and unsuccessful) investments. General AI tools can’t prioritize the metrics that matter most to your strategy, apply your fund’s specific risk assessment framework, or structure analysis in the format your IC memo template requires.

-

Real deal analysis requires reasoning across multiple information sources simultaneously. Unlike humans, who can reflect, reorganize thoughts, and take a step back when faced with complexity, LLMs process text sequentially and in isolation. They rely entirely on the information within their context window to generate each response. This limitation becomes especially apparent in underwriting memo preparation, where understanding the interconnections between financial metrics, industry dynamics, and structural protections is critical. General tools might accurately summarize each component but miss the analytical connections that determine overall credit quality.

A Purpose-Built Alternative

This is where platforms like Deck represent a different approach. Rather than trying to adapt general-purpose tools to investment workflows, or building expensive custom solutions from scratch, purpose-built platforms can democratize access to sophisticated AI capabilities.

Deck was designed specifically for the context-heavy, framework-specific requirements of private market analysis. The platform can ingest and reason across extensive document sets while applying fund-specific analytical frameworks and maintaining the formatting standards and analytical rigor that investment committee presentations require.

For investment teams, these differences translate into tangible workflow improvements. Instead of spending time restructuring generic AI output to fit your analytical framework, purpose-built tools can generate AI investment memo content that already incorporates your fund’s preferred metrics, risk assessment approaches, and presentation formats.

This doesn’t replace professional judgment. But it does enhance it by handling the synthesis and formatting work that consumes significant analyst time, while ensuring the output maintains the analytical sophistication your investment process requires. The result is more time for the strategic thinking and relationship building that actually drive investment success.

For investment professionals evaluating how AI might enhance their processes, the question isn’t whether these tools can be helpful because they clearly can. The question is whether you need a solution designed for the specific demands of private market analysis, with the contextual sophistication and framework awareness that drives real analytical value, or whether you’re satisfied with surface-level assistance despite the documented limitations in context reasoning and multi-source synthesis.

Ready to see how purpose-built AI can enhance your deal analysis workflow? Learn more about how Deck helps private market teams synthesize complex deal information while maintaining their analytical frameworks and quality standards.