Introducing Deck Beta

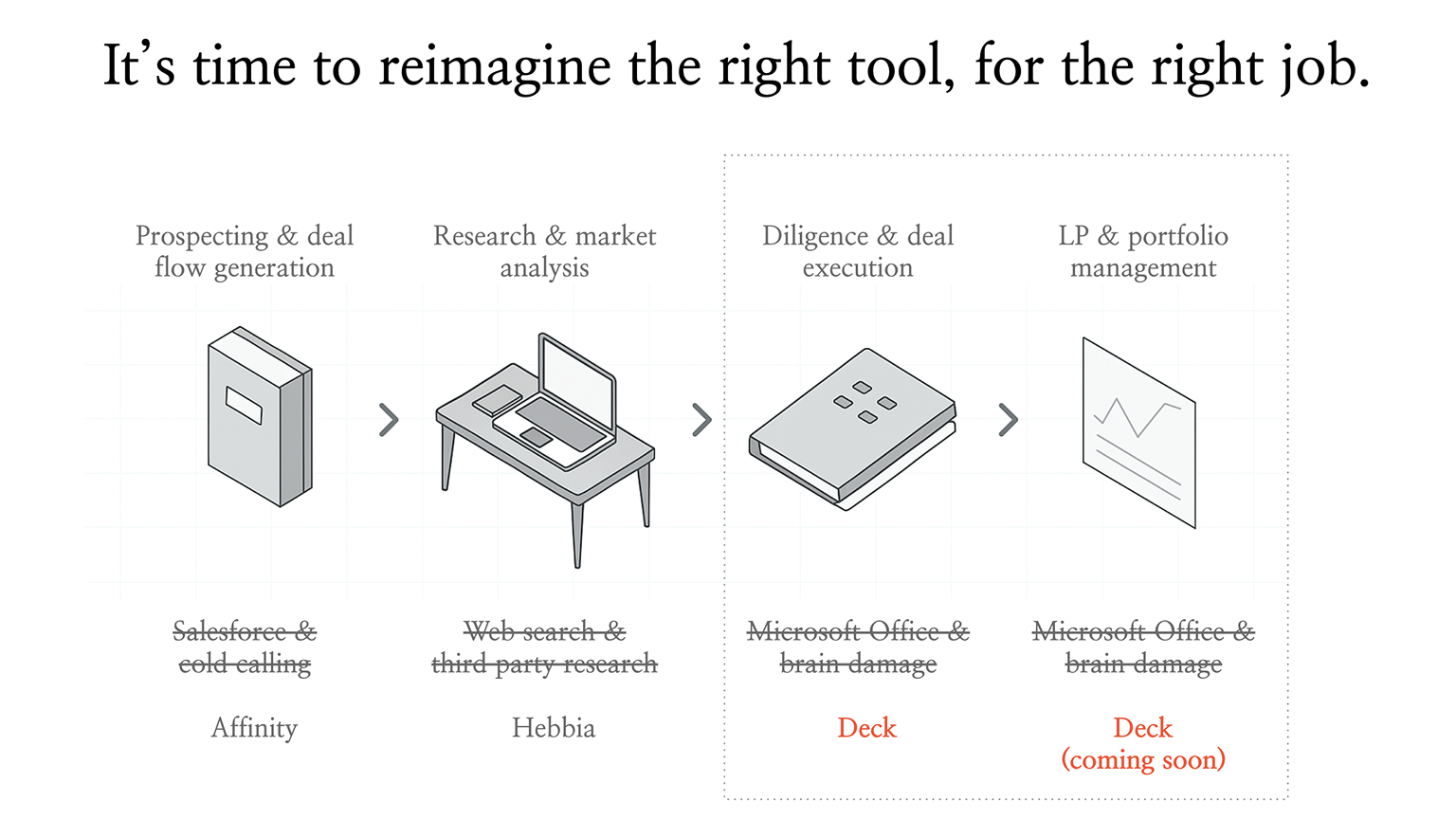

We're excited to announce that Deck is now in beta and we're looking for investment teams ready to reclaim their time from manual research synthesis. If you've ever spent hours consolidating research across data rooms, management presentations, and third-party reports into a coherent investment memo, you know exactly why we built this. The tools available today either tackle narrow pieces of the workflow or require you to rebuild your entire process around their limitations. We saw teams drowning in information while racing against deal timelines, brilliant analysts spending more time formatting than analyzing, and investment committee memos getting rushed because the synthesis process ate up all the available bandwidth.

Deck is designed specifically for private credit, private equity, and VC teams who understand that good diligence requires both speed and rigor. We're not trying to replace your judgment. Instead, we're here to provide leverage. Our beta users include analysts managing multiple opportunities simultaneously, associates preparing IC decks under tight deadlines, and VPs who need consistent quality across their team's output. They all share one thing in common: they recognize that manual document synthesis is a bottleneck.

We believe AI should make investment teams operate as if they have 10x more resources, and that sophisticated AI capabilities shouldn't require McKinsey-scale budgets or dedicated data science teams to implement. It should focus on the here-and-now challenges you're actually facing, not some theoretical future state. Better synthesis means more time for critical analysis. More efficient due diligence memo preparation means capacity for additional deal evaluation. When teams can move faster without sacrificing quality, they can pursue more opportunities, grow AUM, and ultimately generate better outcomes for their LPs. We're not out to replace the human element in investment decisions. We're out to eliminate the friction that prevents you from doing your best work.

We know there are solutions out there that handle parts of the deal chain. CRM systems track your pipeline. Data providers give you market intelligence. Document review platforms organize your files. But the gap between having all that information and synthesizing it into actionable investment analysis? That's where teams are still doing everything manually. Deck sits in that gap, turning scattered research into structured analysis that feeds directly into your investment committee process. We're working with a select group of teams to refine the platform before wider release. If you're tired of watching good analysts burn cycles on document wrangling instead of deal analysis, we'd love to show you what we're building. Join our beta waitlist to get early access and help shape how AI can better serve investment teams.

The future of deal execution is here.

Let's do better work.

Deck is currently in closed beta. Interested teams can apply for early access through our waitlist.